Company owners and heads usually think that using business checks is just a small detail that will consume more fund and time. They have the impression that with the high end technology that we are having right now, there should be no space to allot for using checks. Check is obviously old fashioned but it is also undeniably convenient and very easy to use. Checks are being used for making payments for goods and services by individuals, businesses, and companies. A check is a written order from a specific depositor to a financial institution so that a stated amount of money will be paid to a certain person or business whose name is written in the order. Although not every business or companies make use of checks, a wide range of companies including the small and start up companies use checks in their operations as they are handy for processing payments and a good way to keep a hard copy of financial transaction records. This article will discuss some of the reasons on why business checks are important for a small and start up companies.

Using Checks Guarantees more Security

As we all know, carrying a set of cash and credit cards is no longer that safe nowadays. Checks can be stored or even put in our bags and clutches all day, wrapped in a plain or colored paper or opaque envelopes. Check is safer from thieves and scammers compared to cash and credit cards.

Checks are Best form of Records

Multiple credit card swipes, paying in paper bills, and bank to bank transactions are very easy to do now and doing something easy makes it hard for us to keep track of our expenses. The exact same thing goes for companies, they do have the same challenge of keeping a record of the company fund and necessary expenses. As most of the time, check payments are being done in writing, it will be much easier for one to take note of it and record it in the register. As mentioned, it is much more convenient to have checks kept as a physical record for financial transactions.

Check Serves as a Reliable Proof of Payment

It is quick and easy to prove that the payment has been processed with checks. What is needed is just the canceled check or a screen shot from an online banking website to be shown. Right after cashing the check, there will nothing else that needs to be paid unlike credit cards that immediately grow a balance.

A Good Component for Good Timing

Post dated checks are in good use when a company needs to pay something but is not able to pay in cash right on that day yet. A check can act like a cash in the store but most of the time, takes one or two days to be cashed. For some cases though, some businesses and companies present the checks like a debit card which means that they clear immediately as well.

It is Affordable

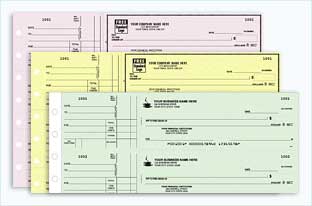

As mentioned, checks do not cost a lot of interest and service fees compared to credit card and bank to bank transactions. It is not correct that using checks for businesses and companies is just a waste of time and money. Convenience is also being promised by Business checks online at Techchecks in very affordable and reasonable prices. A lot of resources and good packages are available either online or through neighborhood banks in order for small business and start up companies to switch some financial transactions to check.

Author Bio:

Victor Evans works at TechChecks. TechChecks is the easiest, fastest and quickest way to order checks online whether for your home or office. They provide Computer Checks, Business Checks, Intuit Checks and many more at the Lowest Cheap Checks Prices.